In

its biggest-ever crackdown on a large-scale money pooling scheme estimated at

nearly Rs. 50,000 crore (twice the amount

to be recover from SAHARA group), regulator SEBI has ordered Pearls Agrotech Corporation Limited (“PACL”) to refund investors within three months and wind up operations.

SEBI

had found PACL violating Collective Investment Scheme Regulations by mobilizing

the money without being registered with the regulator, SEBI.

Besides, closure of PACL operations, SEBI is initiating further proceedings against PACL

and its nine promoters and directors for fraudulent and unfair trade practices,

as also for violation of SEBI's CIS Regulations, among others, as per a

direction from the Supreme Court.

At present, it is being estimated that PACL has

more than 58.5 million

customers, more than twice the 22 million demat accounts in the entire country

and has paid commission of

Rs 7,893.8 crore up to March 2012 to more than its 8 lakh agents who works as network of chain system for collection of public deposit in return for attractive commissions on deposits brought in by them and other agents linked to them in chain. PACL is yet to allot land to 46.3 million investors where as PACL claimed it was in the business of purchasing and developing land, adding the developed land was transferred to investors, who could sell it for gains.

Rs 7,893.8 crore up to March 2012 to more than its 8 lakh agents who works as network of chain system for collection of public deposit in return for attractive commissions on deposits brought in by them and other agents linked to them in chain. PACL is yet to allot land to 46.3 million investors where as PACL claimed it was in the business of purchasing and developing land, adding the developed land was transferred to investors, who could sell it for gains.

SEBI will make a reference to the state governments and local

police to register civil or criminal cases against PACL, its promoters,

directors and managers for fraud, cheating, criminal breach of trust and

misappropriation of public funds if the money is not refunded. SEBI will also

initiate attachment and recovery proceedings if the money is not refunded to

the public within the deadline set by it.

PACL Business Activities

PACL offered two kinds of plans to its customers—a cash-down

payment plan and an instalment payment plan. Under the former, it offered to

allot land to customers within 270 days of payment and under the latter within

90 days. In fact, business model of PACL isn’t very complicated. It collects

money from investors and invests in cheap land which is likely to see changes

in end use. Once that happens, the cheap land becomes a goldmine that PACL

monetizes to pay investors 12.5% interest.

SEBI clamps down the business activities of PACL categorizing

the collection of public deposits under the garb of allotment of farm land to

depositors without any maintenance of proper

records/data and without registration of its scheme with SEBI under Collective

Investment Scheme Regulations is a clear indication the activities of PACL are

in the nature of a Ponzi scheme.

Before moving further let us understand- What is

a PONZI Scheme??

Now,

the most basic questions which arises, has PACL been involved in Ponzi Scheme

or it was failure on part of PACL to get its scheme registered with SEBI under

Collective Investment Scheme Regulations? Has PACL cheated any of its investor

till date?

Though at this moment we may not have all

answers, however few things are very clear:

1. The Collective Investment Scheme operated by PACL

was not registered with SEBI;

2. There are more than 46.31 million customers to

whom PACL is yet to allot land

Today, many companies especially in semi-urban

and rural areas are accepting deposits in their firm’s name and also promising

two to three times returns in two to four years without taking any legal

permissions and there was cardinal mistakes by PACL group that often operated

in the regulatory twilight zone. A shadowy empire giving up closely monitored

financial services to slowly venture into real estate would not have

necessarily drawn the attention of unfriendly politicians and a no-nonsense

SEBI.

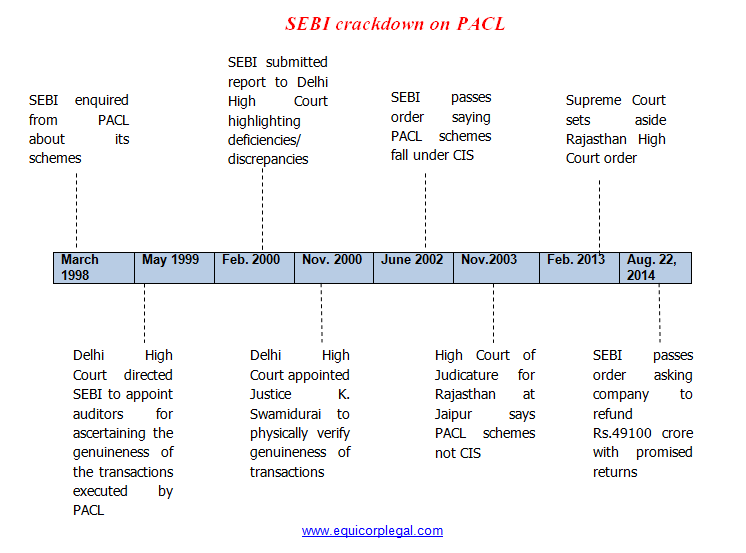

The timelines of battle between PACL and SEBI is

provided as below:

After the first round of battle, where SEBI has ordered

PACL to refund Rs. 49,100 crore to its investors, PACL is getting ready for

second round and to knock on Securities Appellate Tribunal (“SAT”) against SEBIs order. The whole battle between SEBI and PACL is on the

issue that whether the business activities of PACL comes within the ambit of

CIS or not? However, in middle of this battle, there are millions of small

investors who had been exposed to high degree of risk, who may lose everything

if PACL shrinks.

Collective

Investment Scheme (CIS)

w An investment scheme wherein several individuals

come together to pool their money for investing in a particular asset(s) and

for sharing the returns arising from that investment as per the agreement

reached between them prior to pooling in the money and as per Collective

Investment Scheme Regulations, any company involved in CIS has to register with

SEBI .

Though on prima facie it seems that the business activities of PACL is

similar to CIS and we can expect further crackdown on other companies engaged in

similar activities like PACL.

If you are

interested in further details and inclined to know the procedure of CIS

registration, click on the link below:

or contact us at admin@equicorplegal.com/+91

9958709189

This comment has been removed by a blog administrator.

ReplyDeletenice information thanks for sharing valuable content with us we also provide great information related to your blog feel free to visit our

ReplyDeleteStock market.

Hey...Great information thanks for sharing such a valuable information

ReplyDeleteHeidelbergCement India Ltd

Good Article ! Thanks for sharing

ReplyDeleteReliance Industries Limited

Persistent Systems Limited

Bharti Airtel Limited